A common question that often arises for stock market investors, especially those just starting out, is how to read stock charts. Whether you’re a trader or an investor, learning the basics of chart reading is crucial, as it allows you to make informed choices when dealing with stocks, no matter whether you’re investing for the long term or trading for short-term gains in the stock market.

In this blog, we’ll explain how to read stock charts as beginners, using simple language to make it easy to understand.

What is a Stock Chart?

A stock chart is a graphical representation of a company’s stock or an index performance over time. The X-axis, or vertical axis, displays the time range (intra-day, daily, weekly, monthly, or yearly), while the Y-axis, or horizontal axis, shows the stock price. To better understand how a particular stock is doing in the market, stock charts also include additional details and data points.

Why Should You Know How To Read Stock Charts?

Entering the stock market without knowing how to read stock charts is much like attempting to cook without a proper recipe. This makes learning stock chart analysis essential. With this skill, you’ll be able to:

- Pick winning stocks at the right moment.

- Make informed buying decisions.

- Recognize when it’s time to sell a stock.

- Gauge whether a stock is in high demand or is being sold off rapidly.

- Evaluate stock price trends to see if they are volatile, stable, or consolidating at certain price points.

Once you’ve mastered the basics of stock charts, open free Demat account so that you can put your knowledge into practice without any initial costs.

Basic Elements of Reading Stock Charts

Let’s first understand the basic elements that are present in most stock charts.

Stock Symbol and Exchange

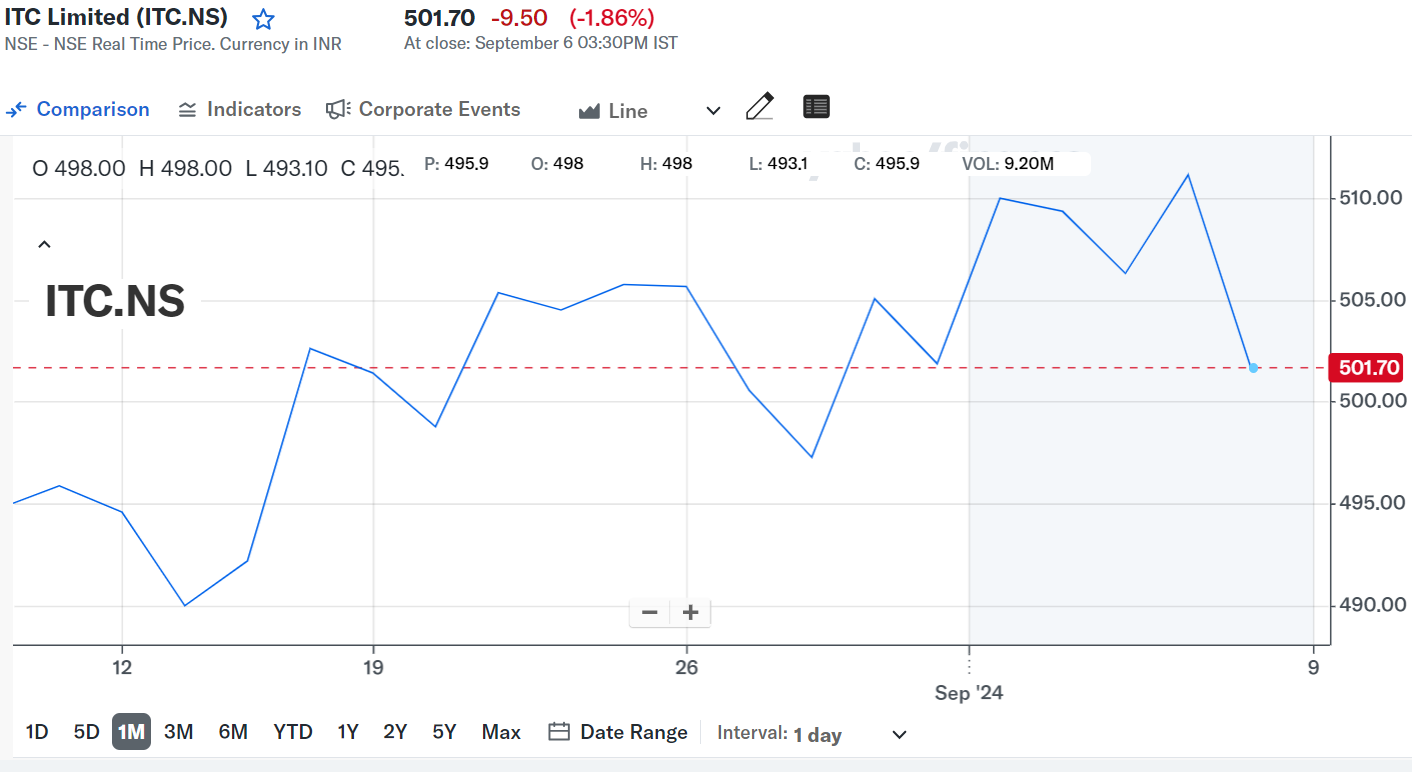

A stock’s symbol, also known as a ticker symbol, is a combination of letters that uniquely identifies it on the stock exchange. For example, “ITC” stands for India Tobacco Company Limited, as shown in the image above. The exchange refers to the platform where the stock is traded, such as the NSE (National Stock Exchange) or BSE (Bombay Stock Exchange). When viewing stock charts, it’s essential to be aware of both the stock symbol and the exchange to ensure you’re looking at the correct stock.

Chart Period

The chart period indicates how much historical data is represented on the chart. You can adjust it to view short-term or long-term trends. For instance, you can choose to look at data for 1 day, 1 week, 1 month, or even 1 year, as shown in the image above. Long-term investors usually prefer longer periods, like 1 or 5 years, to assess a stock’s overall performance. In contrast, short-term traders often focus on 1-day or 1-week charts to get quick insights.

Time Interval

After selecting the chart period, you also need to decide how frequently data points should appear. For instance, if you’re looking at a one-day chart, you can plot data every minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, or 5 hours, depending on your needs.

Price

Once you’ve set your time interval and chart period, the stock chart will display price points for each chosen interval. This includes the stock’s opening price, closing price, highest price, and lowest price. For traders, this can be crucial for understanding the fluctuations in stock prices over specific intervals.

Volume

Volume refers to the number of shares traded during a certain time frame, such as a day. Typically displayed as red and green bars at the bottom of the chart (as shown in the image above), green bars indicate that the stock closed higher than the previous interval, while red bars mean the stock closed lower. High volume often signals strong interest in the stock. For example, if the stock price is rising with high volume, it could indicate strong buying interest and potential for continued price growth.

Understand Three Main Types Of Stock Charts

Stock charts come in a variety of stock market chart types, including bar charts, candlestick charts, line charts, and others, each serving different purposes for traders and investors alike.

Line Charts

Line charts are the most simple type of stock chart, helping you grasp how to read the price movement of the stock quickly. These charts are created by connecting a stock’s closing prices at different points, such as day-to-day or week-to-week. This gives investors a simple, overall view of the stock’s trend. For instance, if you’re reviewing a stock over one month, a line chart will link the closing prices each day, providing a clear picture of the stock’s performance over the past 30 days.

Bar Charts

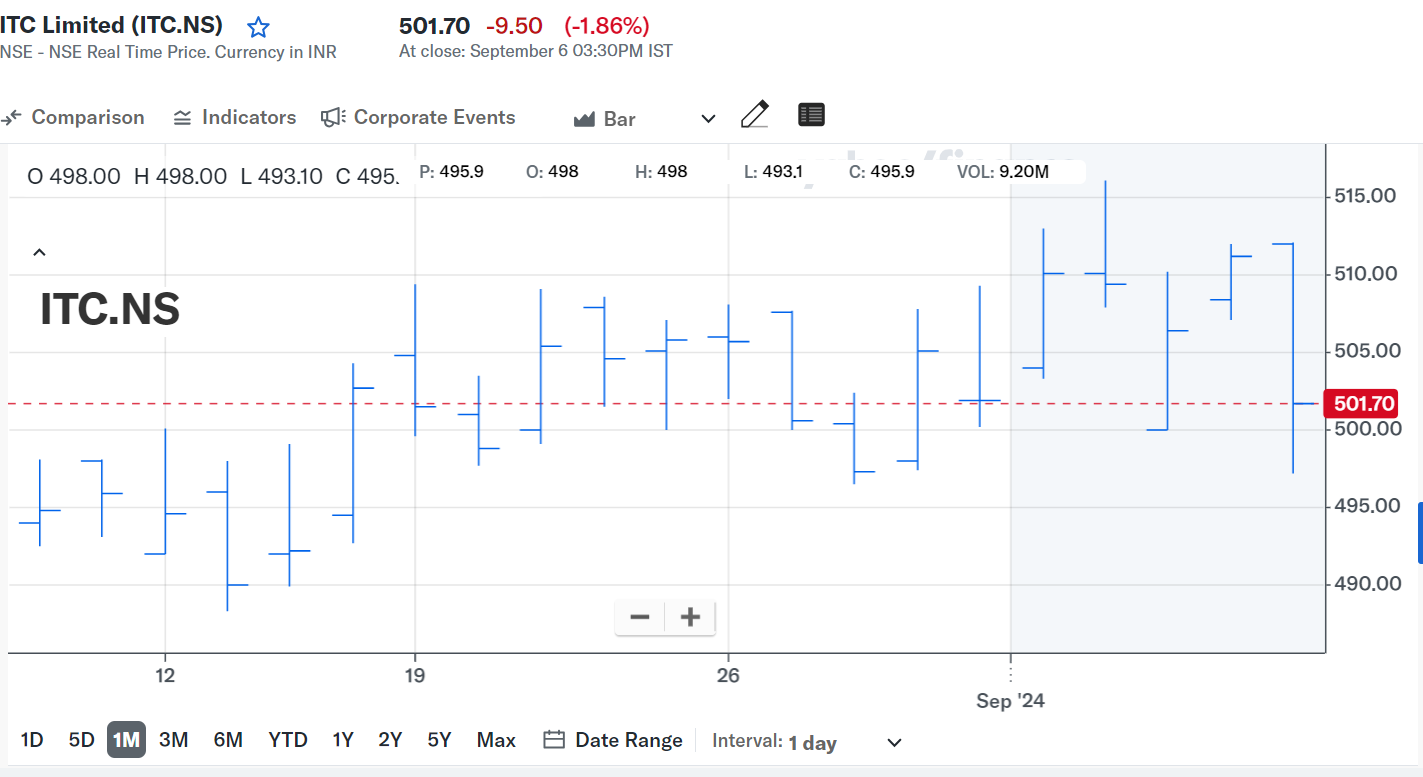

Bar charts provide more insights than line charts by showing four important data points: the opening price, high, low, and closing price. The top of the bar represents the highest price the stock reached, and the bottom shows the lowest. The left tick on the bar marks the stock’s opening price, and the right tick represents the closing price. If the left tick is higher than the right, it indicates the stock had a bearish day, meaning it closed lower than it opened. The bar’s length shows the price range; a longer bar means the stock experienced more volatility.

Candlestick Charts

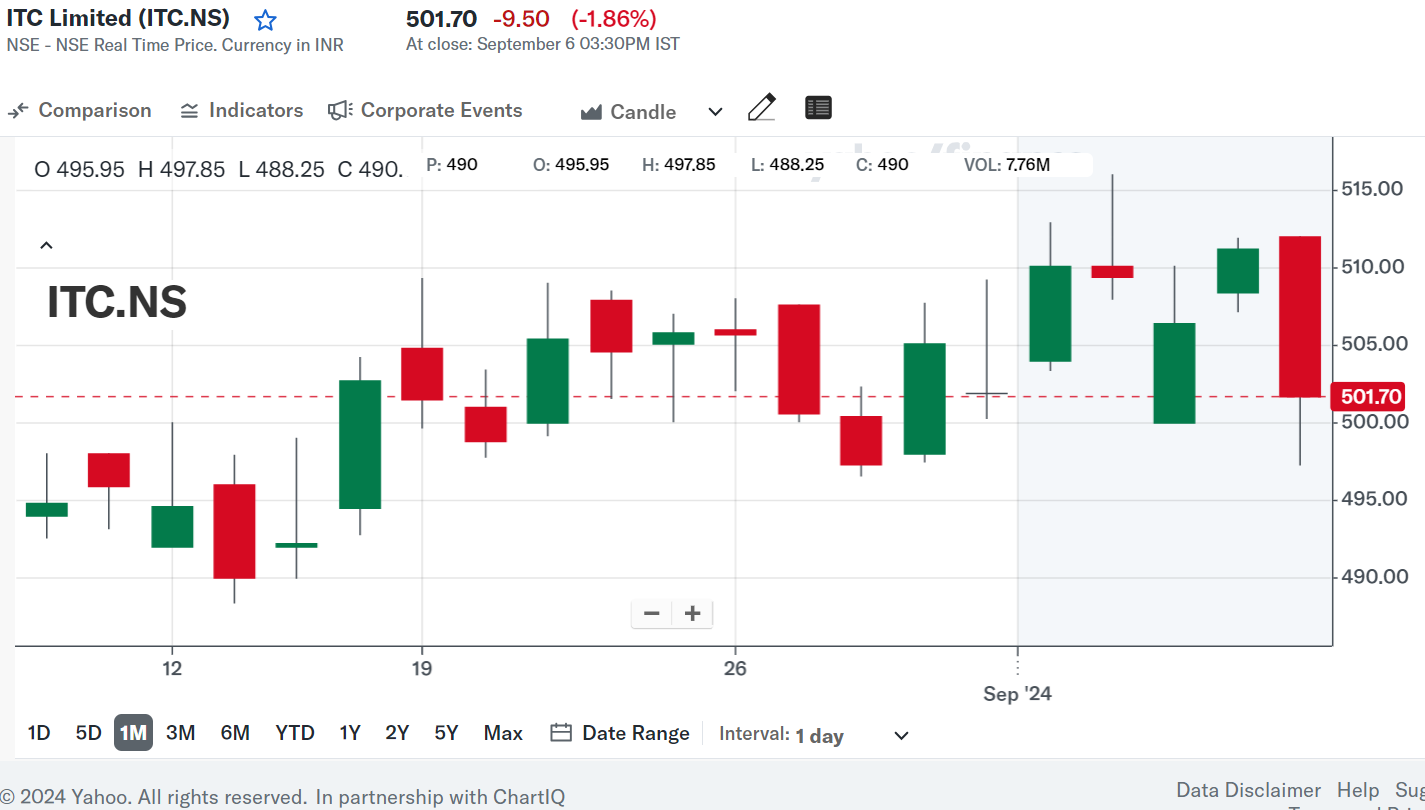

Candlestick charts illustrate the stock’s opening, high, low, and closing prices over a set period. These charts are popular when learning to read stock market charts. Similar to bar charts, they provide all four price points but in a more visually engaging way. The larger part of the candle, called the “real body,” shows the opening and closing prices, while the “wick” above the real body indicates the highest price and the wick below shows the lowest price during that period.

Beyond the basic chart formats like line, bar, and candlestick charts, techniques such as Elliott wave theory offer deeper insights into market trend prediction. The theory suggests that market prices exhibit predictable wave-like movements, making it especially helpful for technical analysts who want to identify price trends and potential reversals.

Conclusion

When it comes to trading or investing in the stock market, knowing how to interpret stock charts can be incredibly useful. These charts show a stock’s price activity over time, giving you valuable information to help determine whether to buy, sell, or hold. By learning basic chart-reading techniques, you can recognise patterns in the stock market, spot trends, and time your entry and exit points more accurately.

However, it’s important to keep in mind that stock charts are only one tool in the broader world of investment analysis. While they offer helpful insights, they should be paired with other resources, like news reports and financial data

For a seamless trading experience, download the HDFC Sky trading app, one of the best trading apps in India with access to over 3500 listed companies. Now featuring TradingView Charts, the app for trading offers basic to advanced charting tools to help you make informed decisions.